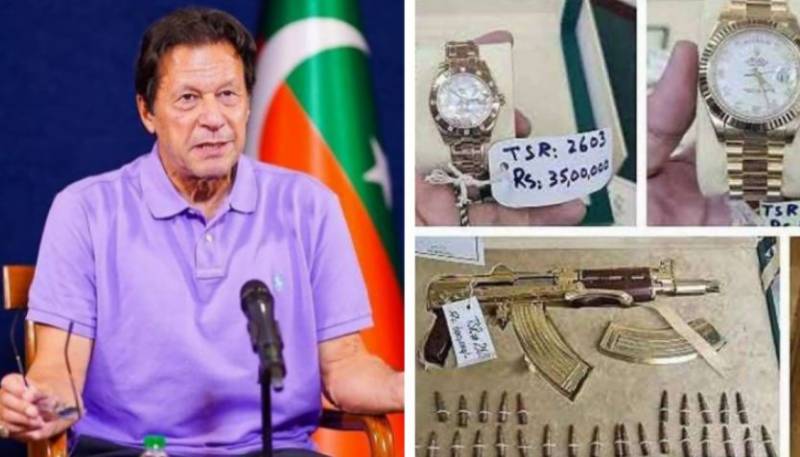

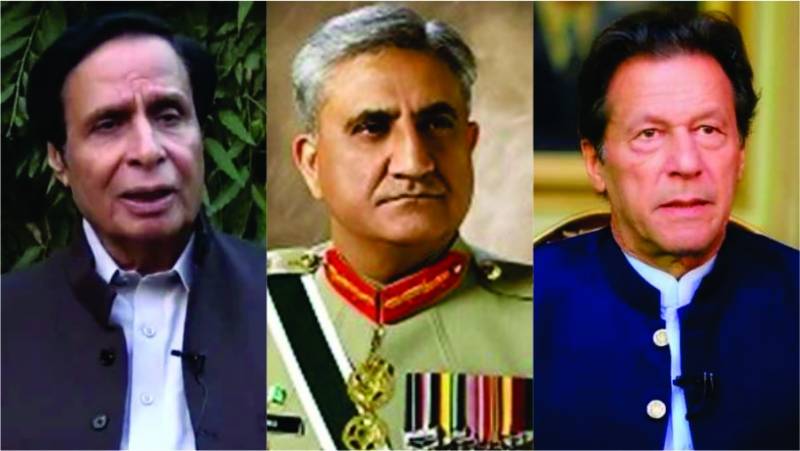

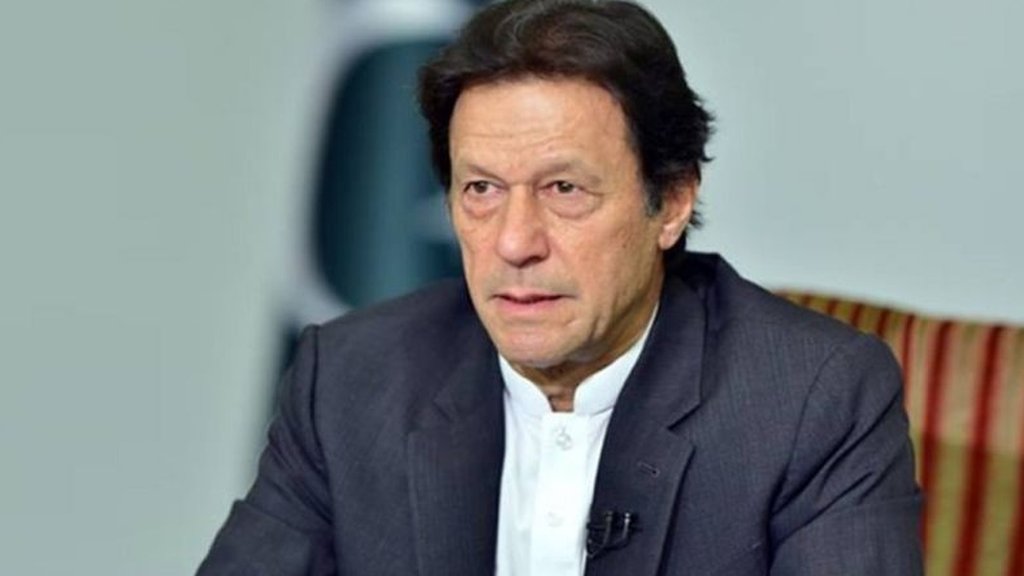

Imran wants NAB law restored

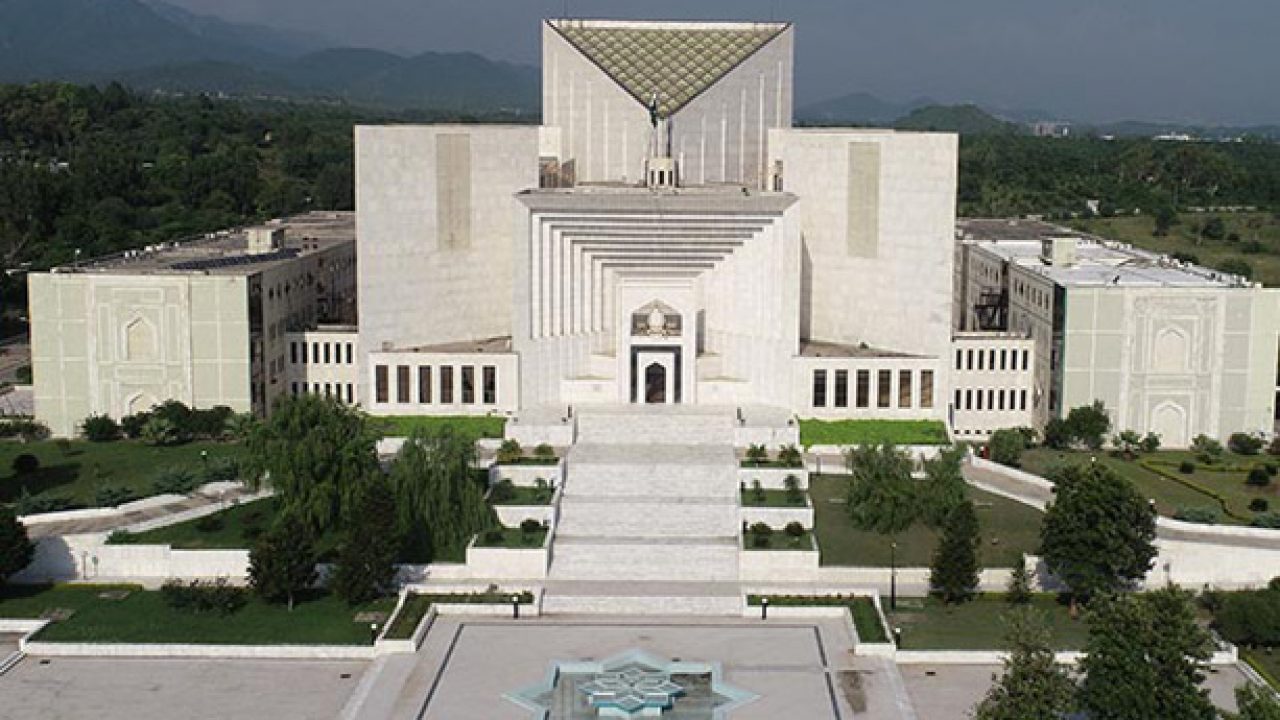

Deposed prime minister Imran Khan has requested the Supreme Court to restore the National Accountability Ordinance (NAO) 1999—a law that governs that country’s top accountability watchdog NAB—in its original form.

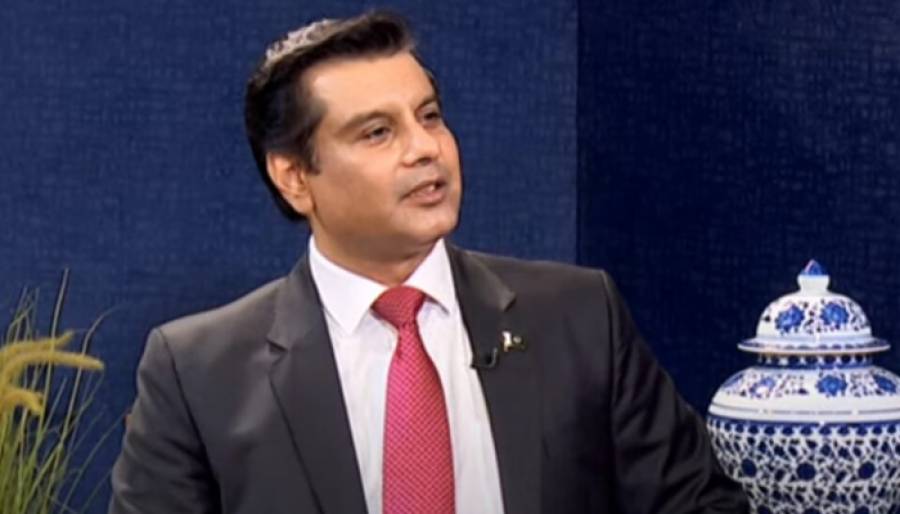

In a 55-page concise statement submitted through Khawaja Haris, the incarcerated PTI chief has contended that the amendments brought to the law last year by the PML-N led coalition government— the National Accountability (Second Amendment), Act 2022— are person or group specific.

“Be that as it may, the very fact that, notwithstanding that the petitioner continues to face the investigation in the two NAB cases under the current law which provides an easy way out to the petitioner from the allegations, he continues to persist with the instant Constitution Petition, and praying for restoration of the law as is existed prior to the impugned amendments,” the statement said.

It said it is claimed that the petitioner—Imran Khan—has not come to the court with clean hands and that his government had itself made similar or identical amendments in the NAO, 1999.

“This actually is not a correct statement. A comparative table of the amendments that had been introduced by the petitioner’s government and were operative immediately before the 2022 amendments introduced by the [PML-N] government is provided.

“This table conclusively establishes the fact that the only amendment introduced by the petitioner’s government, which may be comparable to the amendments introduced by the [PML-N] government, are confined to section 4 of the NAO, 1999.

“And even as regards the amendments introduced by the petitioner’s government in section 4 ibid, there are qualitative differences, both as regards the entities which are excluded from the ambit of NAO, 1999, and the categories of persons who could be prosecuted thereunder, and as regards the manner in which individual categories of offences in terms of their definition. This objection, therefore, is also not tenable”

The statement said introducing these amendments and thereby, in effect, exonerating all the holders of public office from the charges made or framed against them in these references, without being subjected to or going through the process of trial, is actually tantamount to giving legal cover to these holders of public office to retain their ill-gotten gains.

It is also like protesting them from prosecution, or from being held accountable, for their acts which constitute acquisition of billions of rupees worth of ill-gotten gains by corruption or corrupt practices.

“The people of Pakistan are the real beneficiaries of public money, national wealth and state assets, while, as mandated by the Constitution, their elected representatives are trustees thereof.

“Hence, any act of their elected representatives which impedes or bars the people from questioning their elected representatives, or from holding them accountable for committing criminal breach of trust with respect to national wealth, state assets, or public money in the discharge of their duty…is a gross violation of people’s fundamental rights…as guaranteed by Articles 9, 14, 24 and 25 of the Constitution.”

It said in the absence of a strong accountability law, the elected representatives who inevitably by virtue of their office have complete control over the state assets and national wealth belonging to the people, would continue to indulge in loot and plunder thereof with impunity.

The statement said given their retrospective operation, all these amendments are person or group-specific, in that they have the effect of, or are designed to save from prosecution all those holders of public office who were holding seats in legislatures when these amendments were introduced and were facing inquiries or investigation by NAB, or trials or prosecution in accountability courts.

“These holders of public office include persons associated with and belonging to political parties collectively known as PDM, which coalition of political parties was in power at the Center, and had used its majority in the National Assembly and/or the Senate to bring about these amendments.

“So far as there are other persons too who are benefitting from these amendments, they are either the bureaucrats who had worked with these holders of public office, or private persons closely associated with these holders of public office, who had aided, abetted or conspired with [them] in committing the acts of corruption or corrupt practices “.

The statement said as a consequence of the changes made in the NAO, 1999, with respect to the offence falling under section 9(a)(v), all pending trials, inquiries and investigations have come to an end.

Furthermore, in future too, the offence as previously defined in section 9(a)(v) of the NAO, 1999, is no longer an offence of which a holder of public office can be held accountable.

“Rather, its place is taken by a completely new offence. Thus, pursuant to the impugned amendments, an offence under section 9 (a)(v) would be made out only where there is material evidence to establish that the assets (of whatever value) in excess of a holder of public office’s known sources of income have been acquired through corrupt or dishonest means.

“Otherwise, a holder of public office would not be criminally accountable for any asset or set of assets which he owns beyond his known sources of income, even if such assets [are] worth billions of rupees.

“Similarly, a holder of public office may (i) hold in his name an irrevocable power of attorney with respect to property worth billions of rupees or (ii) maintain a standard of living commensurate with the standard of a billionaire, but he can no longer be questioned (i) on what basis he is holding an irrevocable power of attorney qua property worth billions of rupees, nor (ii) from where he derived income to maintain such high standard of living.

“So that even if he is unable to account for it by pleading lawful means or from legitimate sources, he cannot be prosecuted for an offence of corruption or corrupt practices vis-à-vis such assets.”

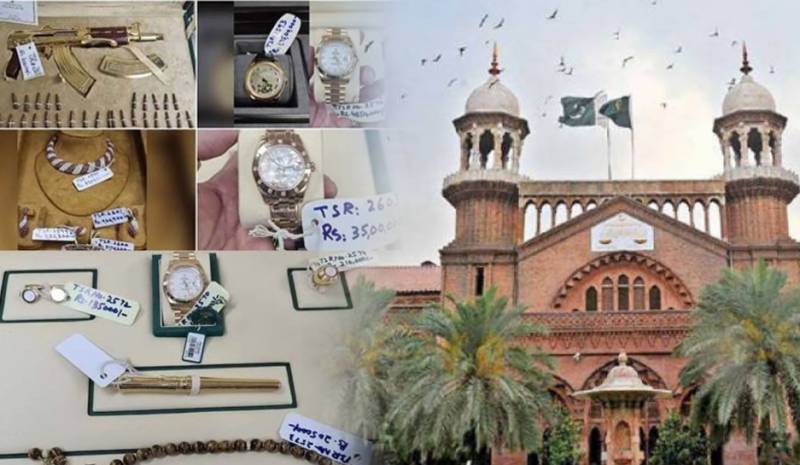

The statement said this amendment actually correlates to a case in which a JIT—constituted by the apex court regarding fake accounts—had submitted a report that revealed that one Ghulam Abbas Zardari had given Faryal Talpur—sister of PPP supreme leader Asif Ali Zardari— a notarized general power of attorney with complete beneficial rights of ownership, sale, disposal of certain properties.

“Because of this amendment, Faryal Talpur cannot be questioned as to why or in what capacity she holds power of attorney with respect to these properties; while 3 other properties mentioned in the same para therein are in the name of her driver…

“But unless it is proved that these properties were acquired by corrupt or dishonest means, NAB cannot question the driver, how these came to be in his ownership, or, for that matter, if Faryal Talpur has anything to do with it,” it said.

The statement said NAB, while investigating a holder of public office for an offence involving owning of immovable assets beyond his known sources of income, is prohibited from ascertaining the actual amount at which such immovable property may have been purchased by the holder of public office.

Rather, NAB is bound to accept either the price of such assets as incorporated in the title document, or price based on valuation made by the district collector (DC) or the Federal Board of Revenue (FBR).

In fact, even if there is evidence contrary to the price/valuation, incorporated in the titled document or that made by the DC or the FBR, it shall not be admissible pursuant to the NAB amendments.

“An illustrative case of how this amendment works to favour an accused in concealing the real price at which he had purchased an immovable property is again to be found in the JIT report.

“Thus, at page 24 of the copy of [the JIT] report placed on record is the finding of ‘Purchase of Clifton Property Through Joint Account’.

“This property was actually proved to have been purchased by Mr Zardari for Rs150 million but on the basis of price quoted in conveyance deed, Mr Zardari claimed it was purchased for Rs50 million.

“As regards movable assets, the definition thereof has been changed so as (i) to exclude the sum total of credit entries in the bank account of a holder of public office to be treated as his asset.

“Rather, now, only the balance lying in his account on the date of initiation of inquiry or investigation by NAB can be so treated,” it said.

The statement said as a result of the impugned amendments, no banking transaction can be considered or treated as an asset belonging to a holder of public office unless there is evidence of creation of a corresponding asset through that transaction.

Thus, it said, any money deposited and thereafter withdrawn from an account, prior to initiation of inquiry or investigation by NAB, either in cash or by way of transfer to another account, whatever the quantum of money involved, cannot now be considered as an asset.

A banking transaction involving a debit or credit entry in any account per se cannot be questioned, unless there is evidence to show that by such debit or credit entry some asset corresponding thereto has been acquired by the account- holders/holders of public office.

“The concrete example of how cash withdrawals per se earlier formed part of investigations and references, but now, due to the change in definition of moveable assets…these investigations and references cannot continue, as such withdrawals had taken place prior to initiation of inquiry/investigation of these accounts, is provided at pages 21-22 of the JIT report.

“These transactions involve a sum of Rs8.3 billion of which Rs3.92 billion constituted purely cash withdrawals apparently prior to initiation of inquiry/investigation, another sum of Rs3.92 billion stood transferred to another account, apparently without creation of corresponding asset…

“A sum of Rs350 million relates to purchase of immovable property of which at least one property purchased for Rs150 million is to be considered as purchased for Rs50 million only, because of the amendments made in 2022,” it said.