HBL delivers profit of Rs 77 billion in 2022, up 24% YoY, with enhanced focus and commitment to clients

KARACHI – HBL today declared a consolidated profit before tax of Rs 77 billion for the year ended December 31, 2022, an increase of 24% over last year. Along with the results, the Bank declared a final dividend of Rs 1.50 per share taking the total payout for 2022 to Rs 6.75 per share. Profit after tax however declined by 3% to Rs 34.4 billion, as a result of retrospective taxation and an effective increase of 10% in the income tax rate for banks, from 39% to 49%.

HBL’s balance sheet grew by 7.4% to Rs 4.6 trillion with total deposits at Rs 3.5 trillion. The Bank increased current accounts by over Rs 200 billion and low-cost savings by Rs 136 billion, closing the year with total domestic deposits of Rs 2.9 trillion; the CASA ratio improved to 86.5%. In line with its stated intent of supporting clients through the cycle, HBL continued its supply of credit, growing domestic advances by Rs 241 billion to Rs 1.4 trillion, a growth of more than 20% over 2021. The Bank’s Advances to Deposit Ratio (ADR) rose to 52.9%.

The flagship consumer business, increased lending by Rs 20 billion to Rs 122 billion, while Commercial lending crossed a key milestone of Rs 100 billion. HBL Microfinance also continued to support the most vulnerable, increasing its inclusion efforts and growing loans by 50% to Rs 85 billion.

Net Interest Income increased by 26% to Rs 166 billion, driven by a Rs 540 billion growth in average balance sheet volumes and margin expansion of 81 bps. The Bank continues to retain its leadership in fee income, which posted a double-digit growth of 24% to reach Rs 31.5 billion. Nearly 50% of the growth came from its market-leading Cards business, where HBL’s Platinum Card is in constant demand. This helped total non-fund income to rise by 29% to Rs 46.7 billion. Total revenue thus grew by 27% over 2021 to Rs 212 billion, HBL’s highest ever.

HBL’s total administrative expenses were Rs 124.8 billion as persistent inflation and rapidly escalating fuel and utility costs created pressure across all categories. The Bank’s infection ratio improved from 5.1% to an all-time low of 4.8% while provision coverage was prudently maintained at above 100%.

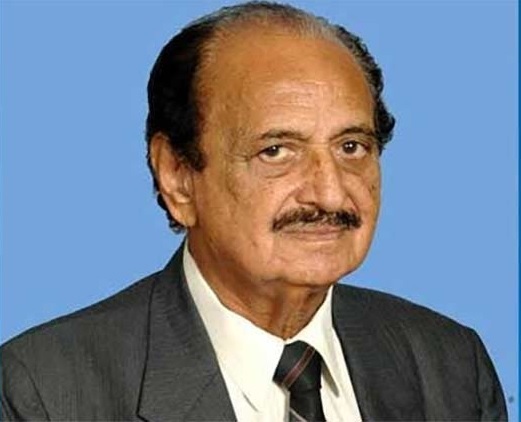

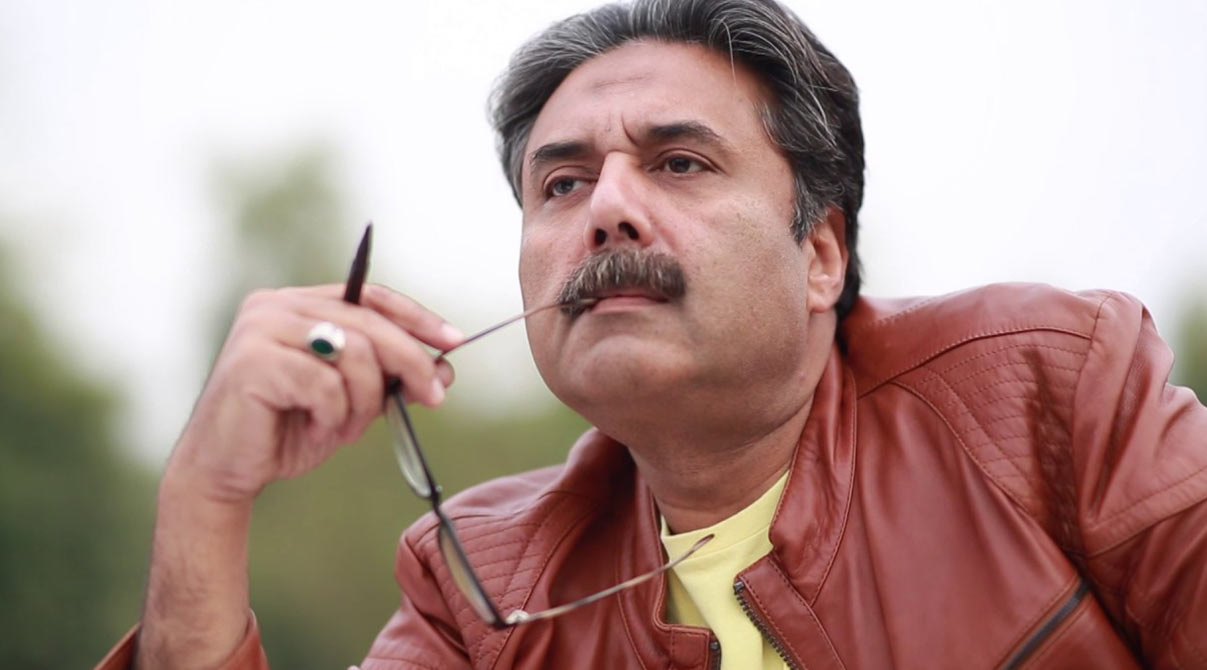

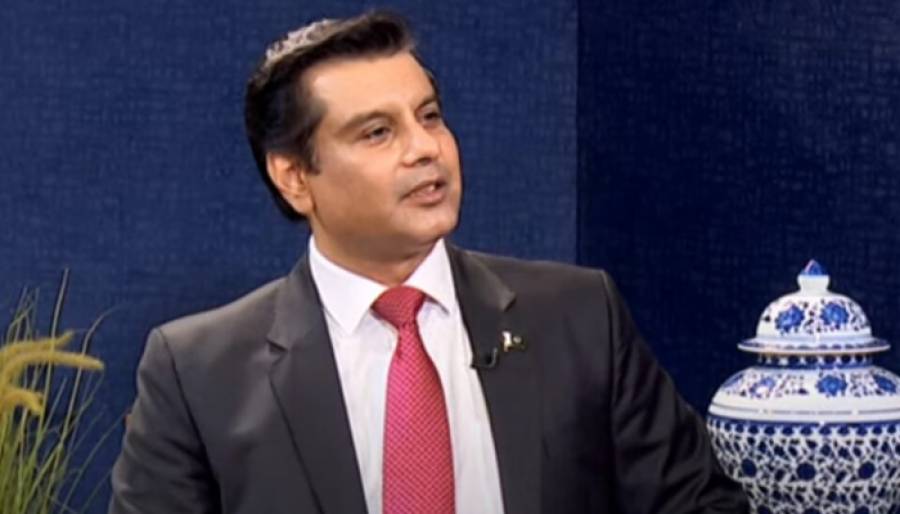

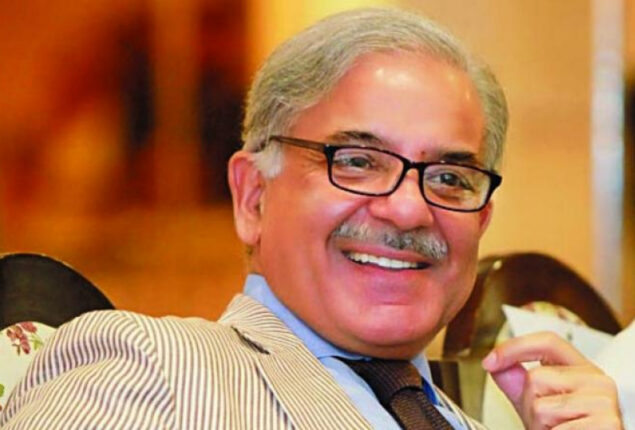

Commenting on the Bank’s performance, Muhammad Aurangzeb, President & CEO – HBL said, “The Bank has delivered excellent results despite the challenging macroeconomic environment. As a testament to our client-centric approach, HBL’s performance was propelled by strong organic growth across all business segments and activity drivers, solidifying our leading position in all client segments. Moreover, HBL is actively working on financial inclusion initiatives supported by significant investments in technology and digitalization. During 2022, HBL remained conscious of its responsibility to support clients and the broader economy.”