Govt raises withholding tax rate for non-filers

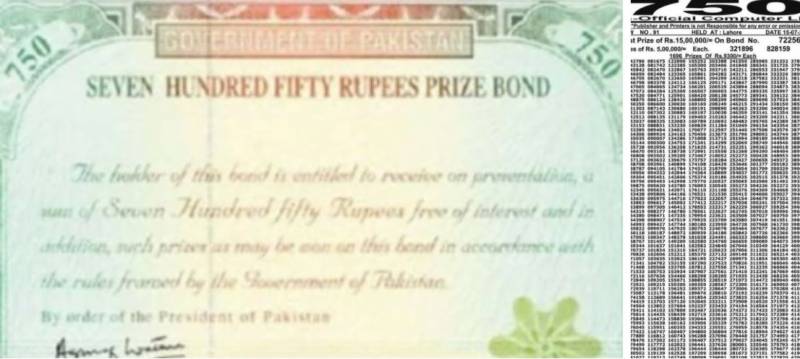

To encourage people to file taxes, the Federal Board of Revenue (FBR) has increased the withholding tax rate for non-activate tax filers or those not on the Active Taxpayers List (ATL).

According to a Wednesday circular, non-ATL filers will be taxed Rs303 for a bank withdrawal of Rs50,500. Those withdrawing between Rs55,000-Rs75,000 will be taxed Rs450.

However, Pakistan’s government agencies and foreign diplomats will be exempted from these taxes.

Additionally, the circular announced that to discourage unnecessary outflow of foreign exchange reserves via credit/debit card transactions, “withholding tax rates have been increased from 1% to 5% for ATL persons and from 2% to 10% for non-ATL persons.”

Furthermore, the circular announced that for those not on the ATL, the tax on motor vehicles has been revised upward by 200% to 18%, 24%, and 30% of the value of motor vehicles having engine capacity of 2001cc to 2500cc, 2501cc to 3000cc and above 3000cc, respectively.

In the case of non-ATL persons, the rates will be increased by 200% — 18%, 24% and 30% — for the same engine capacity.

For those on the ATL, the fixed amount of tax on motor vehicles has been replaced with the collection of tax at the rate of 6%, 8% and 10% of the value of motor vehicle having engine capacity of 2001cc to 2500cc, 2501cc to 3000cc and above 3000cc respectively.

Moreover, it added that where engine capacity is not applicable. The value of the vehicle is Rs5,000,000 or more, “the rate of tax collectible will be 3% of the import value, as increased by customs duty, sales tax and federal excise duty in case of imported vehicles or invoice value in case of locally manufactured or assembled vehicles.”