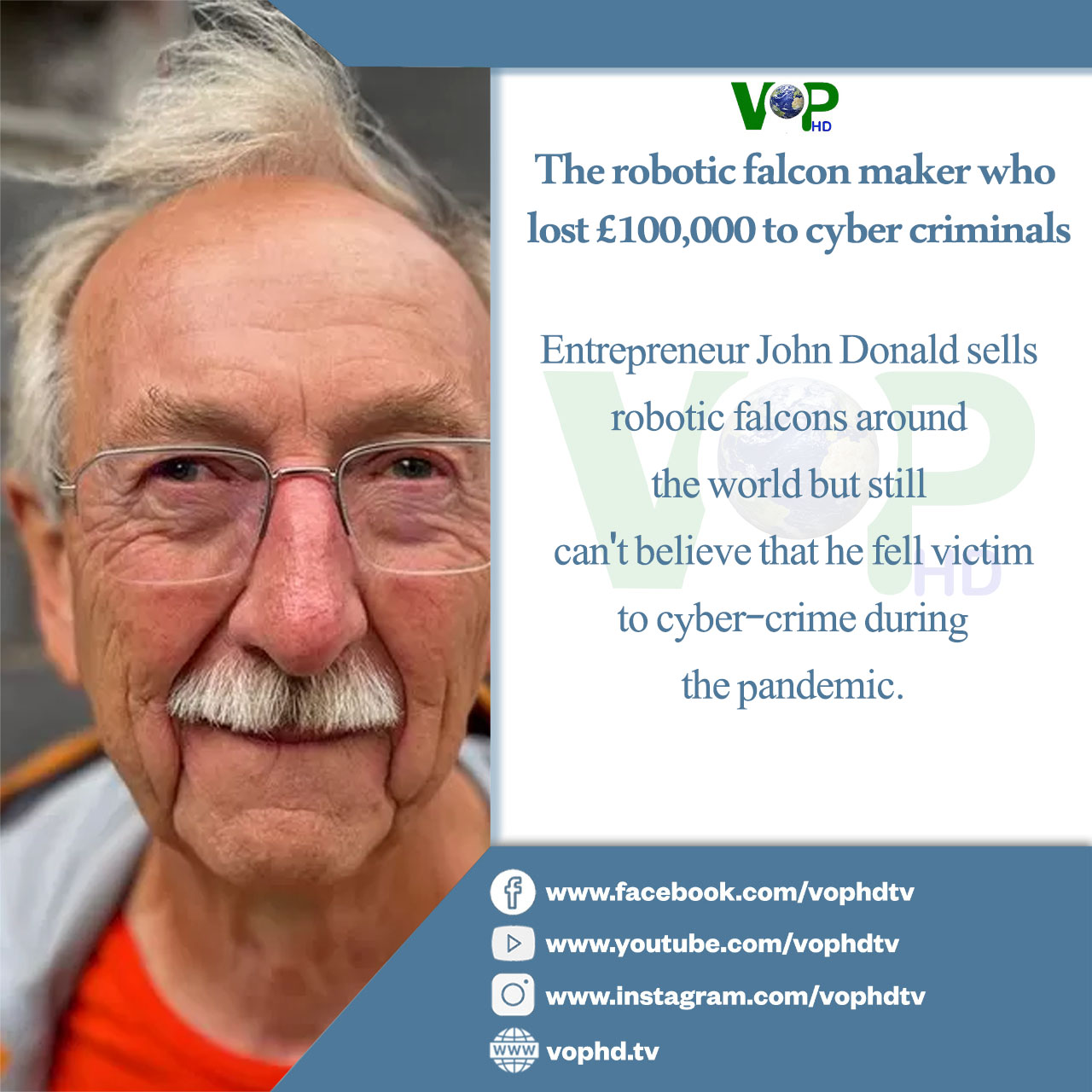

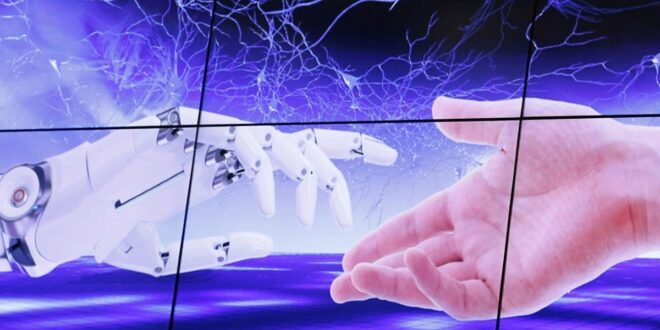

The bosses of Britain’s biggest banks have told Rishi Sunak that technology companies must contribute to the cost of an online fraud “pandemic” that is undermining international investor confidence in the UK economy.

Sky News has obtained a letter to the prime minister signed by the chief executives of nine lenders, including Barclays, NatWest and Nationwide, in which they warned that the UK has become “a global hotspot for

They said the government’s National Fraud Strategy, unveiled last month, were inadequate to tackle the scale of the crisis, which they believe is costing more than £1bn every year to tackle.

The bank chiefs told the PM that £2,300 was stolen from British consumers every day last year by fraudsters.

And they said that they would consider taking further action “to protect our customers” without wider government intervention, including slowing down payments, which they described as “a useful but blunt instrument that will mean some customers and businesses will find their legitimate transactions held up”.

“Online fraud poses a strategic threat to the prosperity of the UK and impacts the credibility of, and confidence in, the economy and financial sector,” they said in the letter, sent on June 6.

They want tech companies to be responsible for stopping scams at source, to contribute to refunds for victims of fraud originating on their platforms and for a public register showing the scale of tech giants’ failure to prevent scams.

The banks’ collective intervention underlines growing frustration at the fact that big technology companies such as Meta Platforms, the owner of Facebook, Instagram and WhatsApp, are bearing so little of the financial burden generated by fraud.

This week, TSB wrote to the New York-listed company to demand that it polices its social media operations more robustly.

The TSB chief executive, Robin Bulloch, was among the signatories to the joint letter to the PM.

The others were Dame Alison Rose, the NatWest CEO; Debbie Crosbie, Nationwide chief executive; Lloyds Bank Group chief Charlie Nunn; Ian Stuart, boss of HSBC UK; Matt Hammerstein of Barclays UK; Mike Regnier, CEO of Santander UK; Mikael Sorensen of Handelsbanken; and Anne Boden, the outgoing CEO of Starling Bank.

It was also signed by Bob Wigley and David Postings, respectively the chairman and chief executive of UK Finance, the banking lobby group.

In it, they urged Mr Sunak to take further steps to combat “the devastating impact fraud is having on people, businesses, and the UK economy”.

“Online fraud poses a strategic threat to the prosperity of the UK and impacts the credibility of, and confidence in, the economy and financial sector,” they said.

“This should not be seen just as an issue for the UK’s banking sector.

“It is having a material impact on how attractive the wider UK financial sector is perceived by inward investors, which as we know, is critical for the health of the City of London and wider UK economy.”

Billions lost to fraud

The chiefs highlighted a UK Finance report which concluded that £1.2bn was lost to fraud of all kinds last year, and welcomed the appointment of Anthony Browne, the Conservative MP and former British Bankers’ Association chief.

They told Mr Sunak that the overwhelming majority of scams targeting UK consumers “originate with a small number of tech firms, social media firms and telcos”.

“A fraud strategy that fails to mandate action on all actors involved in the fraud journey and collective responsibility for the harm done to consumers, will never be effective.

“We are not confident that voluntary measures to be placed on the technology and telecommunication sectors will deliver the change required to reduce the UK’s attractiveness to fraudsters and prevent harm to customers.”

They complained that banks’ efforts to tackle the issue were being impaired by the Financial Ombudsman Service, which they said had placed a disproportionate burden on their industry.

The bosses also said recent conversations with government officials had not instilled confidence in Whitehall plans to clamp down on fraud.

They called on Mr Sunak to make voluntary measures aimed at the telecoms and tech sectors mandatory, and said they should be forced to educate consumers on the security and data risks of making payments.

Tech companies should also be obliged to provide more visible warnings to customers, the bank bosses said.

“One area that we believe requires urgent focus is that of the proliferation of purchase scams on META platforms, which is disproportionately higher than its peers,” they said.

“Tech firms, telcos and social media companies should bear responsibility for stopping scams at source and contributing to refunds when their platforms are used to defraud innocent victims.”

The bank chiefs claimed to have spent more than £500m in the last three years “building defences that help us stop more than £2bn a year in attempted fraud”.

Among their other requests to Mr Sunak was that data should be published regularly to name and shame tech companies over the level of fraud originating from their platforms.

“We can all see how these firms harvest user data for advertising revenue purposes: this in turn must offer ways to intervene to protect users from unscrupulous actors,” they said.

The bank chiefs also called on the government to be “more ambitious than the 10pc reduction [in online fraud] it is targeting which would still leave more than two million customers a year suffering harm.

“With collective commitment across the pillars the Strategy could be even more ambitious and aim for a more credible 25pc reduction in fraud.”